Five Professionals. Zero Coordination.

One Wrong Move Can Cost You Everything.

When your financial life spans multiple advisors, entities, and strategies, the greatest risk isn’t volatility.

It’s fragmentation.

Most families with complex financial lives already have capable professionals in place.

- A CPA.

- A wealth advisor.

- An attorney.

- An insurance specialist.

- Often a business or deal advisor.

Each does their job well.

But when decisions are made independently, small gaps quietly become major liabilities.

That’s where preventable financial damage occurs.

How Coordinated Planning Prevents Silent Financial Failures

What a Virtual Family Office Actually Is

A Virtual Family Office is not an additional advisor.

It’s not a referral list.

And it doesn’t replace the professionals you already trust.

It is a coordinated planning framework.

One where:

- Tax strategy informs investment decisions before execution

- Investment activity is reviewed ahead of deadlines

- Legal structures align with titling, beneficiaries, and intent

- Insurance funding and performance are actively monitored

- Business and personal planning are fully integrated

- Specialists collaborate proactively around one plan

Instead of independent experts working in parallel, you get one unified system with shared accountability.

This is our philosophy.

Why Families With Complexity Choose This Model

As financial lives grow more layered, risk doesn’t usually appear as a single mistake.

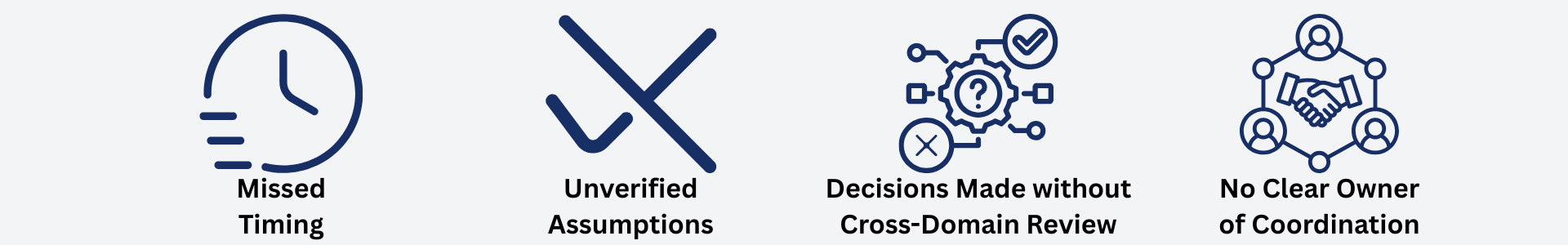

It appears as:

A Virtual Family Office exists to remove those blind spots before they compound.

Who This Is For

This structure is designed for individuals and families who:

If one advisor operating alone feels insufficient, that instinct is correct.

A Safe Next Step

No products.

No pressure.

No commitment.

Just a private review of:

- Where coordination may be breaking down

- Where timing risk exists

- Where execution needs verification

- Where no one currently owns the full picture

Because the most expensive financial mistakes aren’t caused by bad decisions.

They’re caused by good decisions made in isolation.